Nueva Global Holdings is a global systematic investment manager. Our centralised research is focused on the creation of cutting-edge quantitative methods for identifying market opportunities and applies them in a structured way that produces effective exposures.

Nueva Global Holdings gives clients the scale of a major asset management company with the advantages of a flexible investing platform—customization and flexibility—and a strong infrastructure. The fundamental building blocks for today's evolving investing environment are available from our firm to institutional and retail clients.

Our principles and ambitions

From the perspectives of an asset owner, an asset manager, and a business all on our own, we approach sustainability.

Our approach in all three of these jobs is unified by a common set of values and aspirations, which are listed in the box at the bottom of the page, even though our duties and obligations in each of these three roles may vary, as we explore below.Together with choosing the financial results we want our asset managers to achieve for us, it is equally necessary for us to specify the sustainability criteria we expect them to follow.

As an asset manager, we also make investments on behalf of our clients who are individual savers and asset owners. We managed more than £233.4 billion for external clients as of December 31, 2020, and £133.8 billion on behalf of our internal client.

There may occasionally be variances in the sustainability criteria that external clients mandate, and these may, in turn, differ from the demands of our internal client.

The asset manager and asset owner are independently regulated organisations with independent Boards and governance systems, and their policies may occasionally diverge even though our values of care and integrity guide all of our sustainability efforts.

Integrating sustainability goals and principles into our business

Our sustainability objectives, beliefs, and goals relate to both our internal company operations and the investments we make as an asset manager and asset owner.

Our values in sustainability:

- We will integrate sustainability concerns into every aspect of our operations.

- We determine ESG risk elements and include them in our overall risk management procedure.

- We shall operate our businesses in accordance with the same ethical standards that we demand of our investee companies.

- We want to lead the way in innovation, expand sustainable knowledge, and be a thinking leader.

- We support active asset ownership and management because it motivates businesses to move towards a sustainable future.

CORE PRINCIPLES

We are an established fiduciary for client assets.

OUR SUSTAINABILITY STRATEGY IS UNDERPINNED BY CONSISTENT EVOLUTION AND A LONG-TERM APPROACH.

ESG INTEGRATION

Throughout our investment teams and business divisions, we include environmental, social, and governance information into our analysis and decision-making.

STEWARDSHIP

We are active stewards of the entities in which we invest; this goes hand-in-hand with our active investment approach.

CORPORATE RESPONSIBILITY

ESG is ingrained in our business activities through our corporate responsibility program. This includes our Barings Social Impact philanthropic program, as well as our focus on diversity, equity and inclusion across our business.

OUR SUSTAINABILITY GOVERNANCE, RESOURCES AND PARTNERSHIPS

DEDICATED RESOURCES

Our dedicated resources help develop and deliver our sustainability and ESG strategy, policy, partnerships, research, training and reporting.

INDUSTRY PARTNERS

We are a signatory to the Principles for Responsible Investment, a member of the United Nations Global Compact and Climate Action 100+, and public supporters of the Task Force on Climate-related Financial Disclosures. We work to advance the missions of these industry partnerships.

FORMAL GOVERNANCE

Our Sustainability Committee consists of senior

business leaders and is tasked with supporting

sustainability strategy execution.

Our Sustainability Working Groups focus on long-term

strategic projects and regularly meet and report to the

Sustainability Committee.

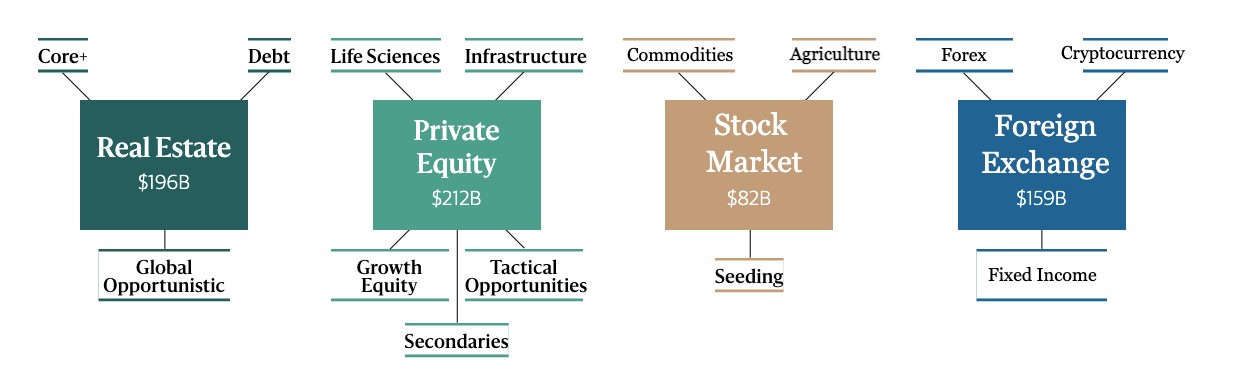

$649B AUM

We continue to build on our track record to innovate into new strategies, drive growth, and serve our investors.

HOW WE WORK

Outstanding team

Nueva Global Holdings is a tightly knit group working together with management teams toward common goals. We have more than 70 investment professionals, including 24 partners with an average tenure at Nueva Global Holdings of more than a decade. This allows us to devote substantial time to the companies in which we invest.

Collaborative style

Our objective is to work with portfolio company leadership and create a backdrop in which companies can thrive. We encourage management teams to invest alongside us, and our forward-thinking approach and philosophy to leave companies better than when we found them also means that portfolio company employees often choose to invest alongside Nueva Global Holdings as well.

Alignment of interest

We believe that people thrive when they are working toward a common and focused goal. We are proud of our transparency and alignment of interest with our portfolio companies and investors. We believe our focus and significant skin in the game allows us to build true, successful partnerships.

Investment Criteria

Nueva Global Holdings seeks to make investments in companies that meet the following investment criteria:

Led by managers with an established track record of achievement

Participate in economically attractive, fragmented, niche industries with strong fundamentals

Demonstrate a sustainable competitive advantage, including an ability to grow, innovate and withstand economic downturns

Possess strong market positions, attractive cash flow attributes and high return on investment enabling them, inter alia, to service a leveraged capitalization

Enjoy excellent organic or acquisitive growth prospects

Nueva Global Holdings has experience executing the following transaction types:

Management buyouts of public and privately held companies and divisions of larger companies

Recapitalizations of closely held businesses in order to provide additional financing or liquidity for existing investors

Acquisitions of companies seeking the financing required to execute consolidation strategies in fragmented but attractive industries

Selected equity financing of growth companies that have demonstrated significant potential Equity investments in growth companies

Investments in companies participating in industries in which Nueva Global Holdings has extensive investment experience

We are taking all measures to ensure we manage to safely get through this fluid situation while continuing to serve our customers, partners, and employees effectively.